Despite popular belief, paying back your student loans doesn’t have to be complicated. But there are mistakes many borrowers make that hurt their ability to pay back their student loans and maintain a good credit record. Making these mistakes won’t mean disaster, but they can make the payment process much harder than it needs to be.

Here are five of the most common student loan mistakes we’ve seen:

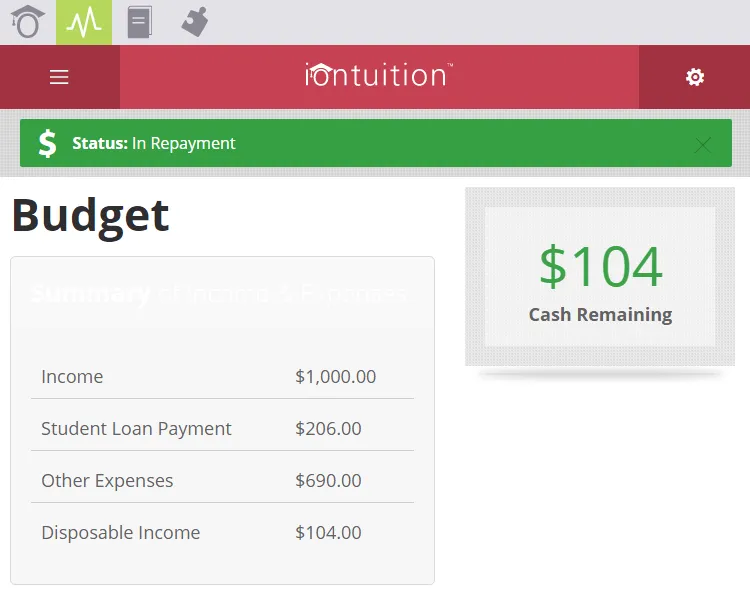

Not setting up a budget

Before you can start repaying your student loans, you need to know how much you can afford to pay each month. Use the budget calculator on iontuition to easily determine what you are able to afford. If you find out you can’t afford to pay much, don’t worry. Budgets can be tight for people who have just left school. Knowing what your budget is now will keep you from making the next common student loan mistake – choosing the wrong repayment plan.

Choosing the wrong student loan repayment plan

You have a choice in what repayment plan you use to pay back your student loans. Standard repayment, graduated repayment, and income-sensitive plans are all options. A standard plan will have a set payment that will pay off your student loan in ten years. A graduated plan will start with a lower payment that increases as time goes on. It’s also a ten-year plan, but will be lower than the standard plan at the start and higher at the end. Income-sensitive plans will have payments at a level that you can afford based on your income and will take 15 to 20 years to complete. Learn more about them on ionLearn and use the repayment dashboard on ionManage to see which one will work with your budget. Then contact your loan servicer and set up the repayment plan you need.

Not paying extra

If you find out you can add an extra $10 per paycheck to your payment, go for it. That could be an extra $240 a year toward paying back the loan. Same with any bonuses or monetary gifts you get. Even an extra $50 will help in paying down your balance.

Missing payments

If you’re scheduled to make a payment, make sure you don’t miss it. There are plenty of reasons why you might miss a payment: you had unexpected expenses, you didn’t get a chance to send it out on time, or you just forgot. But missing even one payment will make you delinquent. If you know you can’t make a payment that month, contact the loan servicer through iontuition and see about a one-month deferment. You can also use iontuition to set up email or text reminders when the payment is due or even set up automatic payments. Not only will you not have to remember it every month, there are discounts available for borrowers who use automatic payments.

Paying too much

There are plenty of companies that claim to “take care of” your student loans for a fee. The only person who can take care of your student loans is you. But there can be benefits to paying for tools to help you . iontuition includes budgeting and repayment planning tools, easy access to student loan experts, and detailed information on student loan and financial terminology.

These mistakes are common. If you’ve already made one or two of them, don’t worry, you can recover from it. With the right student loan management tools, the repayment process can be painless. Create an iontuition account today to get started.

![]()

Tom Wray is all about the research, getting it right, and making it relevant. He’s got solid journalistic experience in all forms of content delivery – and he’s got his keyboard humming with what’s up and important for students, college admins, parents, employers and news junkies.