The end of the federal student loan repayment grace period has been a financial rude awakening for millions of borrowers. After the pandemic-related pause on payments since March 2020, the Department of Education’s 12-month “on-ramp” program, which temporarily suspended penalties for missed payments, concluded on September 30, 2024.

As federal student loan payments resumed, many borrowers could not make their payments, indicating that a rise in delinquency and a return of defaults are expected in 2025. We’re now learning which types of borrowers are have the hardest time making payments.

Survey: Many Student Loan Borrowers Unprepared for the End of the Grace Period

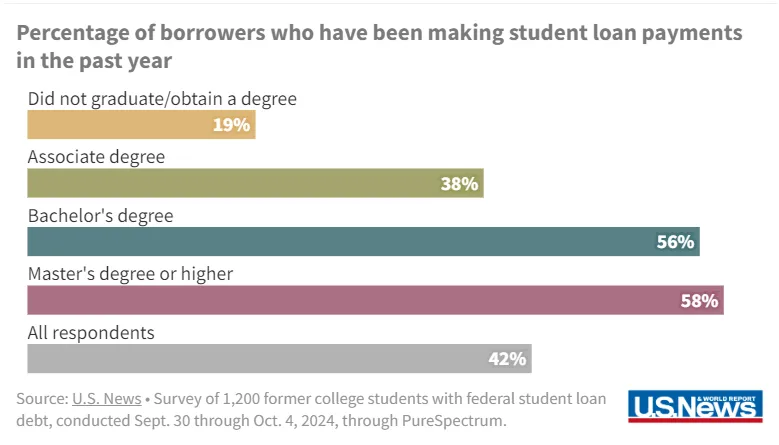

A recent survey revealed that only 42% of student loan borrowers are making regular on-time payments. This puts many at risk of delinquency and default, particularly those who have not made payments or enrolled in deferment or forbearance.

The return of student loan repayment has caused considerable stress among borrowers, with 86% experiencing some stress related to their debt. Nearly a quarter of respondents described their stress levels as “extreme.” Many borrowers continue to advocate for student loan forgiveness, with 77% supporting another attempt to cancel student loan debt.

- 63% reported financial hardship, with many struggling to manage other expenses. Commonly impacted areas include credit card bills (31%), housing costs (21%), and auto loans (17%).

- Over half (57%) have reduced savings, including emergency funds and retirement contributions, to keep up with payments.

- Alarmingly, 62% wouldn’t be able to cover a $1,000 emergency expense using cash or savings alone.

- 65% of borrowers have adjusted their credit card spending habits, with some becoming more reliant on credit to meet daily expenses.

Borrowers without Degrees Struggling the Most

- Borrowers without degrees are at a higher risk of delinquency, with only 19% having made any payments in the past year, compared to 50% of degree holders. Additionally, only 31% of non-degree holders were aware of the expiration of the “on-ramp” program.

Reaching out to non-completers is an opportunity for schools to keep those borrowers from defaulting by re-enrolling them to complete their degrees. A strong incentive to re-enroll is the in-school deferment, no student loan payments are required while they’re working on their degree. And then, after graduation, they’ll be able to earn more money and afford their payments.

Record-High Defaults Expected

Now that the grace period has ended, borrowers face more than just credit score damage if they miss payments. Loans can eventually enter default, leading to wage garnishment, tax refund offsets, and potential legal consequences.

Colleges will also be held accountable through their Cohort Default Rates. Schools that exceed the threshold for defaulted borrowers could risk losing their Title IV lending status.

As a result, schools need a strong Default Aversion program to help educate borrowers about their payment options and guide them into sustainable repayment plans including income-driven repayment (IDR) plans.

Borrowers should be notified when changes in student loan policies occur, especially when it impacts their plans. Many borrowers expect their loans to be forgiven and avoid payments. They need to be told that they can make minimum payments through an IDR plan and still qualify for forgiveness without risking delinquency. The SAVE plan is still under a court injunction, but other IDR paths have opened up.

Staying informed and taking proactive steps can help borrowers manage their student loans more effectively.