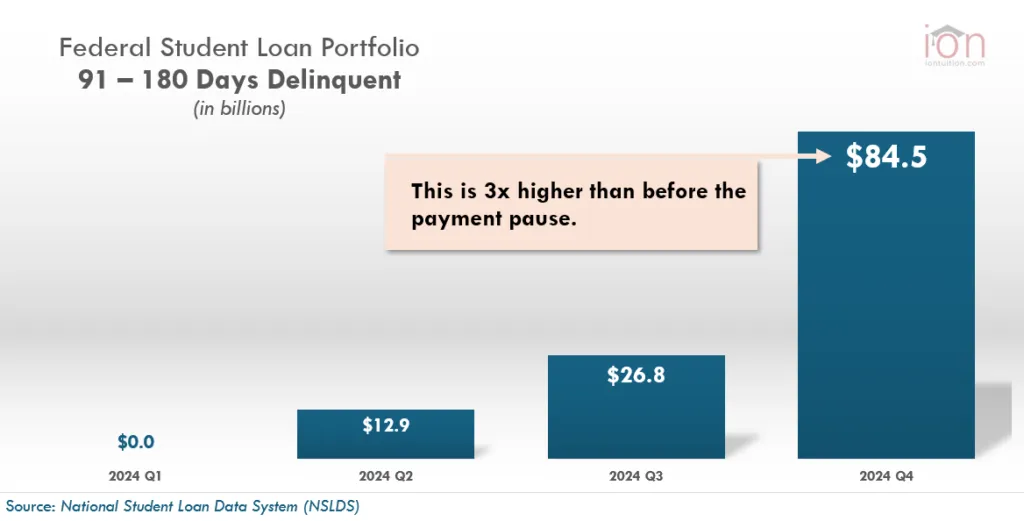

The return to student loan payments has been rocky, with millions of borrowers now delinquent. Approximately three million student loan borrowers are over three months behind on their payments. According to the National Student Loan Data System (NSLDS), the federally managed 91-180 Days Delinquent bucket portfolio is $84.5 billion for Q4 of 2024. This figure is nearly three times higher than before the three-year COVID-19 payment pause. The 91-180 Days Delinquent amount was $27.5 billion for less than a million borrowers in Q4 of 2019.

Millions of borrowers are facing negative credit reporting and are at risk of defaulting on their loans. This alarming figure indicates high Cohort Default Rates are coming.

Why is student loan delinquency so high?

Several interconnected factors contribute to this unprecedented surge in delinquencies. The end of the federal student loan payment pause in September 2023 included a 12-month on-ramp without consequences for late payments to give borrowers time to find sustainable repayment plans. However, the confusion of loan forgiveness, growing inflation, the legal battles over the SAVE plan, and over three years of non-payments have all contributed to an atmosphere where borrowers are unwilling or unable to pay.

Here are some key reasons why delinquencies are high:

1. Borrowers are Unaccustomed to Paying

The extended payment pause significantly impacted borrower behavior. Three years of not making payments created a powerful conditioning effect, making it difficult for many to re-integrate student loan payments into their budgets. This has resulted in widespread under-budgeting for this now-resumed expense.

Compounding this issue is a concerning lack of awareness among some borrowers regarding their repayment obligations. It’s not uncommon for individuals to be unaware they even have outstanding student loan debt, sometimes mistakenly believing their financial aid consisted solely of grants. This lack of awareness, coupled with the ingrained habit of non-payment, creates a significant hurdle for borrowers now facing repayment.

2. Servicer Changes and Lost Contact Information

Several student loan servicers have changed or transferred their portfolios over the last three years. Many borrowers are unaware of who their new servicer is or that their servicer has changed. Likewise, many borrowers may not have updated their contact information with their servicer. This makes it difficult for borrowers and servicers to connect and communicate payment obligations.

3. Promises of Loan Forgiveness

The repeated discussions and promises of sweeping student loan forgiveness during the Biden administration have created a perception among borrowers that they shouldn’t be paying their loans. Borrowers who paid off their loans but would have qualified for loan forgiveness had they waited do not receive a refund. Borrowers may have believed that their loans were already forgiven, or believe their loans will be forgiven. Those borrowers with lost contact information may believe their loans have been forgiven since they haven’t received any communications.

4. Lack of Immediate Consequences

There were no consequences for missed payments during the payment pause and the 12-month on-ramp period. This month marks the first time student loan borrowers will be reported to credit agencies for delinquency. Some borrowers are likely unaware of the consequences of delinquency and default or are comfortable with those consequences.

5. Unawareness of Repayment Options

A survey from last September found that 2 out of 3 student loan borrowers are unaware of income-driven repayment options. These are likely the same borrowers who would qualify and benefit the most from an IDR plan. With the SAVE plan stuck in legal jeopardy, the Department of Education has revived two IDR options: the Income Contingent Repayment (ICR) and Pay As Your Earn (PAYE) plans. Side Note: The Department of Education announced this week that borrowers on the SAVE plan and currently in forbearance could remain in forbearance until September and may not own any payments until December.

For borrowers not enrolled in SAVE, the other IDR options can significantly lower monthly payments if they’re even aware of them. A CFPB student loan borrower survey from last November found that 42 percent of borrowers have only ever been on the Standard Repayment plan and a third of those borrowers didn’t know they could choose a different plan.

Colleges Can Avoid High Cohort Default Rates

While proactive student loan default aversion plans are designed to prevent delinquency by guiding borrowers toward sustainable repayment options from the outset, many institutions now face the challenge of re-engaging borrowers who have already fallen behind.

IonTuition partners with colleges to effectively lower their Cohort Default Rates (CDR) by directly assisting delinquent borrowers. We work to identify and implement sustainable payment solutions, such as income-driven repayment (IDR) plans, tailored to each borrower’s unique financial situation.

Borrowers can easily enroll in IDR plans through IonTuition’s user-friendly portal, or they can receive personalized guidance from our team of student loan repayment specialists who can explain all available options and navigate the enrollment process.

By leveraging IonTuition’s expertise and resources, colleges can effectively address current delinquencies and mitigate future defaults, ultimately protecting their institutional standing and supporting student success. Contact our sales team today to implement a comprehensive default aversion strategy for your institution.