Student debt is the literal price many of us pay to earn a college degree. Our college degrees will continue to have value as long as employers are seeking candidates with professional certification and a formal education.

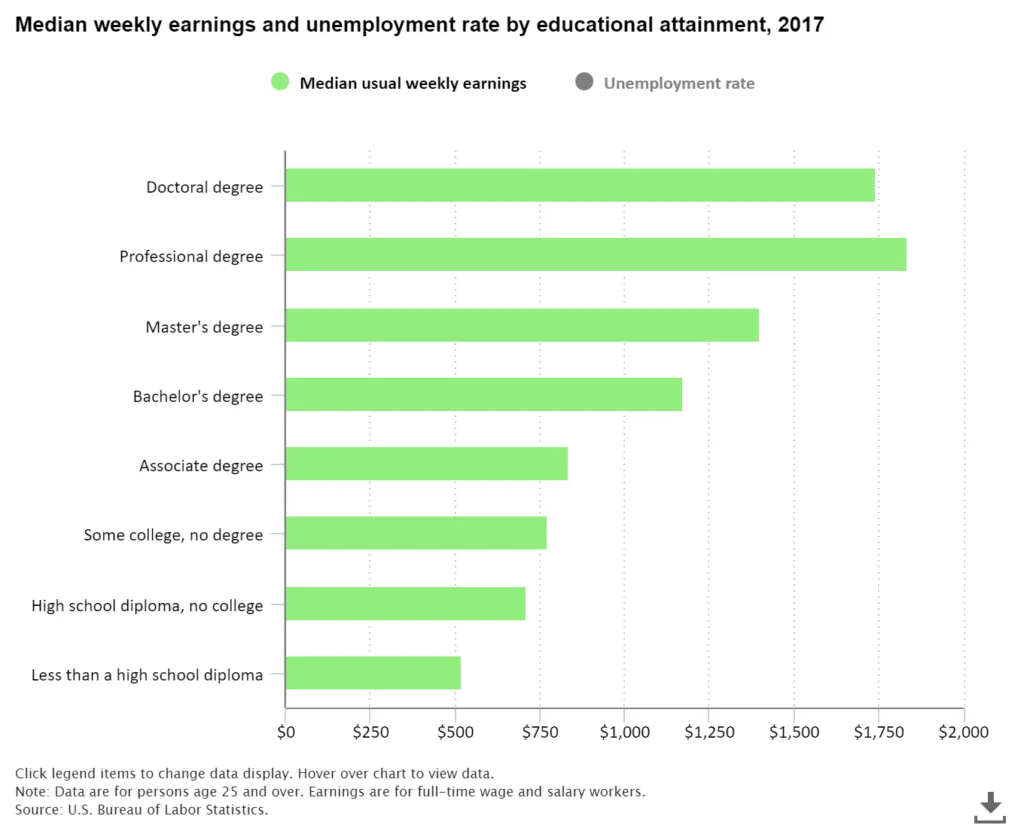

The cost of college can have variable impact on future earnings, depending on the type of school you attend. Traditionally, professions requiring more schooling have higher incomes after graduation. Overall, college graduates have a higher median wage and lower unemployment rate than those without a college education.

High Earners, Not Rich Yet (HENRYs)

The term HENRYs was coined by Fortune Magazine in 2003 to

describe individuals earning over $250,000, but not having

much left after taxes, housing, and most significantly, student

loan payments. These professionals are earning high salaries,

but since they began their career buried in debt it can take

years before they are financially stable.

For example, the average medical school debt of $189,000

carries a $2,100 monthly payment (not including any additional

undergraduate loans). Worse, many graduates with Ph.D’s use

forbearance to postpone their student loans while they complete internships, causing their debt to grow even more from accruing interest.

As a result, many HENRYs find themselves living paycheck-to-paycheck, and if necessary, skipping or falling behind on their student loan payments to cover more pressing forms of debt.

Student Loan Delinquency Rates are Higher Than Other Forms of Debt

The amount of seriously delinquent student debt (90+ days past due) is hovering around $200 billion out of the $1.5 trillion student debt portfolio.

Student loan delinquency rates are consistently higher than mortgage, auto, and credit card debt. For example, the delinquency rate for student loans in the healthcare sector is five times higher than credit card debt for accounts reaching 90 days past due, according to IonTuition’s workforce financial analysis reports.

What To Do About Student Debt Delinquency

Employers can help those struggling to repay their loans by offering a comprehensive student loan repayment benefit designed specifically to guide borrowers into sustainable repayment plans. Most likely if an employee is not earning enough to cover their student loan payments, they will qualify for at least one of four income-driven repayment plans available to federal loan borrowers.

IonTuition includes self-service online calculators to pre-qualify employees for plans that lower payments and access to concierge loan advisors to oversee the entire application process.

With the number of protections and plan options available, no person should ever default on a federal student loan, yet it’s happening at a growing rate. Forbes predicts that 40% of student loan borrowers may be in default by 2023. Employers can help their workforce by offering a financial wellness benefit such as IonTuition to guide struggling borrowers into better repayment scenarios.