Remember the old saying, “if something seems too good to be true, it probably is.” Keep that in mind when seeking student loan forgiveness. While there are paths to loan forgiveness, they often take many years and contain very specific qualifications.

What does student loan forgiveness mean?

Whether you’re looking for student loan forgiveness, cancellation, or discharge – the result is no more student loan payments and a permanent $0 balance with your servicer(s).

How can I qualify for student loan forgiveness?

The federal student loan program includes several paths to student loan forgiveness. It’s important to carefully explore each option as there are very specific conditions to qualify. In most cases, the fastest way to be clear of your student debt is to follow the 10-year standard repayment path.

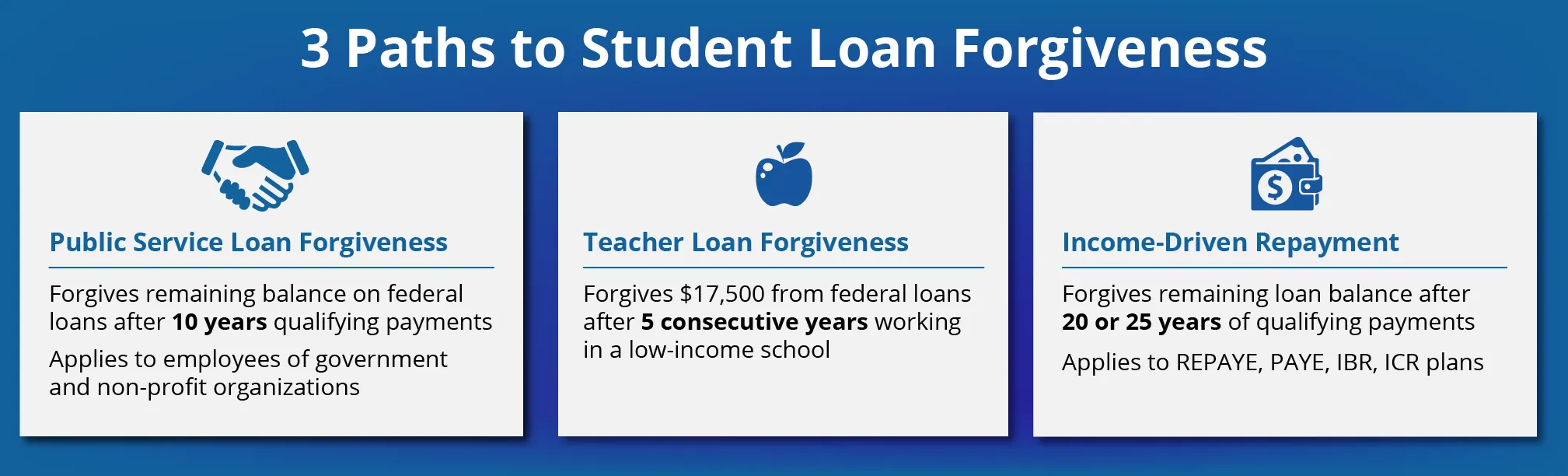

Public Service Loan Forgiveness (PSLF)

- The U.S. Department of Education may enact new conditions to the PSLF program following the Consolidated Appropriations Act, 2018. PSLF was designed to forgive the student loans for public servants in government and non-profit organizations after 10 years of qualifying repayment. The intention was to influence more college students to enter public service, however recent activity in congress suggest this program’s future may be in jeopardy.

Teacher Loan Forgiveness Program

- If you’re a full-time teacher and have completed five consecutive academic years working in a low-income school or educational institution, and you have qualifying loans with qualifying payments, you may be eligible to have up to $17,500 forgiven from your federal student loans.

Forgiveness under an Income-Driven Repayment (IDR) Plan

- Several of the federal income-driven repayment plans (REPAYE, PAYE, ICR, & IBR) offer forgiveness after 20 or 25 years of qualifying repayment. Keep in mind the an IDR plans require annual renewal and that your payments will fluctuate as your income changes. Also, extending your payment to 20 years results in more time for interest to accumulate, so it’s possible that you’ll end up paying the same amount or more over 20 years that you would have paid under the standard 10 year plan.

Other Options for Student Loan Forgiveness

Death and Disability Discharge

- If you die or become totally and permanently disabled, your family can apply to have your student loans discharged.

Bankruptcy Discharge

- It is very unlikely, but still possible, that your student loans could be discharged through bankruptcy. Since there are a number of federal income-driven repayment plans that could lower your payments to $0 per month, most bankruptcy courts will not rule to discharge your loans.

Closed School or False Student Eligibility Discharge

- If your school closes while you’re still enrolled, or closes within 120 days after you withdraw, you may be eligible to have your Direct, FFEL, or Perkins loan discharged. Likewise, if your school falsely certified your eligibility for a student loan, you may qualify for a discharge.

If you Can Afford to Repay Your Loans, You Should

Waiting for student loan forgiveness is not ideal. There’s no guarantee the programs will remain in place and while you wait, that interest is accumulating. Income-driven repayment plans are wonderful to lower your monthly payments in the short-term. Often, the most economical method to repaying your loans is to pay them off as quickly as possible.