The growing challenges facing higher education present significant threats to college budgets. Proposed legislative changes and a looming default crisis threaten to strain institutional resources.

To protect higher education budgets, colleges must prepare against these issues:

Elimination of Grad & PLUS Loans

The potential elimination of Graduate and Parent PLUS loans could create a financial aid gap for students, creating revenue loss for colleges.

Graduate programs, often vital revenue sources for higher ed, would face instability. Colleges must explore alternative funding models to offset these losses, potentially expanding their institutional loan programs to support graduate students.

Elimination of Subsidized Loans

Past and current budget proposals have floated the idea of ending federally subsidized loans while an undergraduate is in school and during grace periods.

Ending subsidized loan interest means students accrue interest in school, leading to bigger loan balances after graduation, or if the student drops out. This could deter enrollment and increase financial aid needs, both would be detrimental to higher education budgets.

Proposed Cap on Undergraduate Title IV Loans

Capping undergraduate Title IV loans could lead to enrollment declines, directly affecting higher education budgets.

Institutions must find ways to bridge funding gaps and prepare to provide alternative financing.

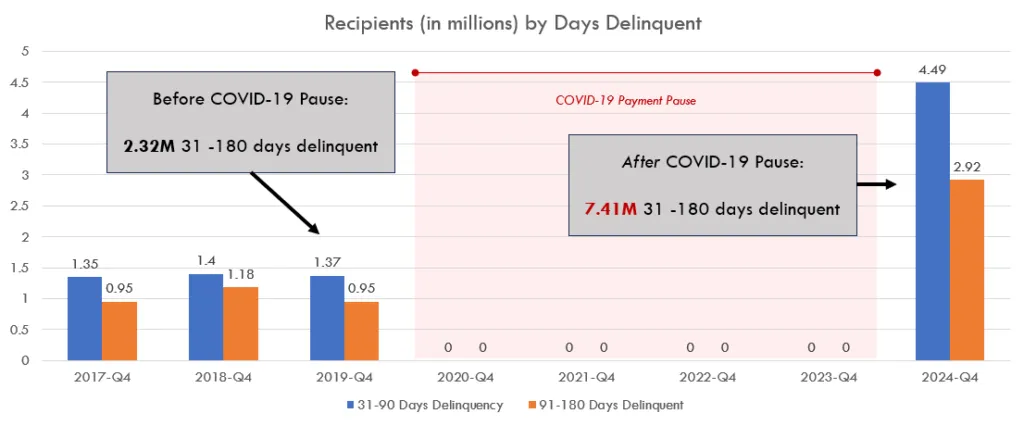

The Looming Default Crisis

The growing delinquency crisis, with millions of borrowers at risk of default, substantially threatens Title IV eligibility for institutions. High default rates trigger institutional penalties and jeopardize federal funding.

The first technical defaults since the end of the on-ramp period will begin on June 28th.

College Cost Reduction Act Call for Penalties from Defaults

The College Cost Reduction Act would impose direct penalties on schools with high default rates, severely impacting higher education budgets.

ION’s default aversion solutions become essential to avoid these penalties, making them a cost-neutral investment.

Elimination of SAVE and Reduction of PSLF Write-Offs

Limitations to loan forgiveness programs could influence career choices and deter students from seeking public service options. Likewise, the elimination of the SAVE income-driven repayment plan could cause many students to reconsider whether higher education is an affordable option for them. Schools should prioritize affordability in their strategic enrollment process to ensure more students follow through on their starts.

Cost-Neutral Solutions to Protect Higher Education Budgets

ION’s comprehensive solutions offer a cost-neutral approach to managing these challenges, especially when implemented together:

- Enrollment Management: Optimize marketing and admissions budgets while growing enrollment.

- Private Loan Servicing: Efficiently manage private loan portfolios, reducing administrative burdens, minimizing default risks, and improving repayment rates.

- Default Aversion: Implement proactive strategies to reduce defaults, avoiding costly penalties and protecting federal funding.

By partnering with ION, colleges can mitigate the financial risks associated with policy changes and ultimately protect and optimize their higher education budgets. The return on investment from ION’s services makes it a cost-neutral option for colleges.