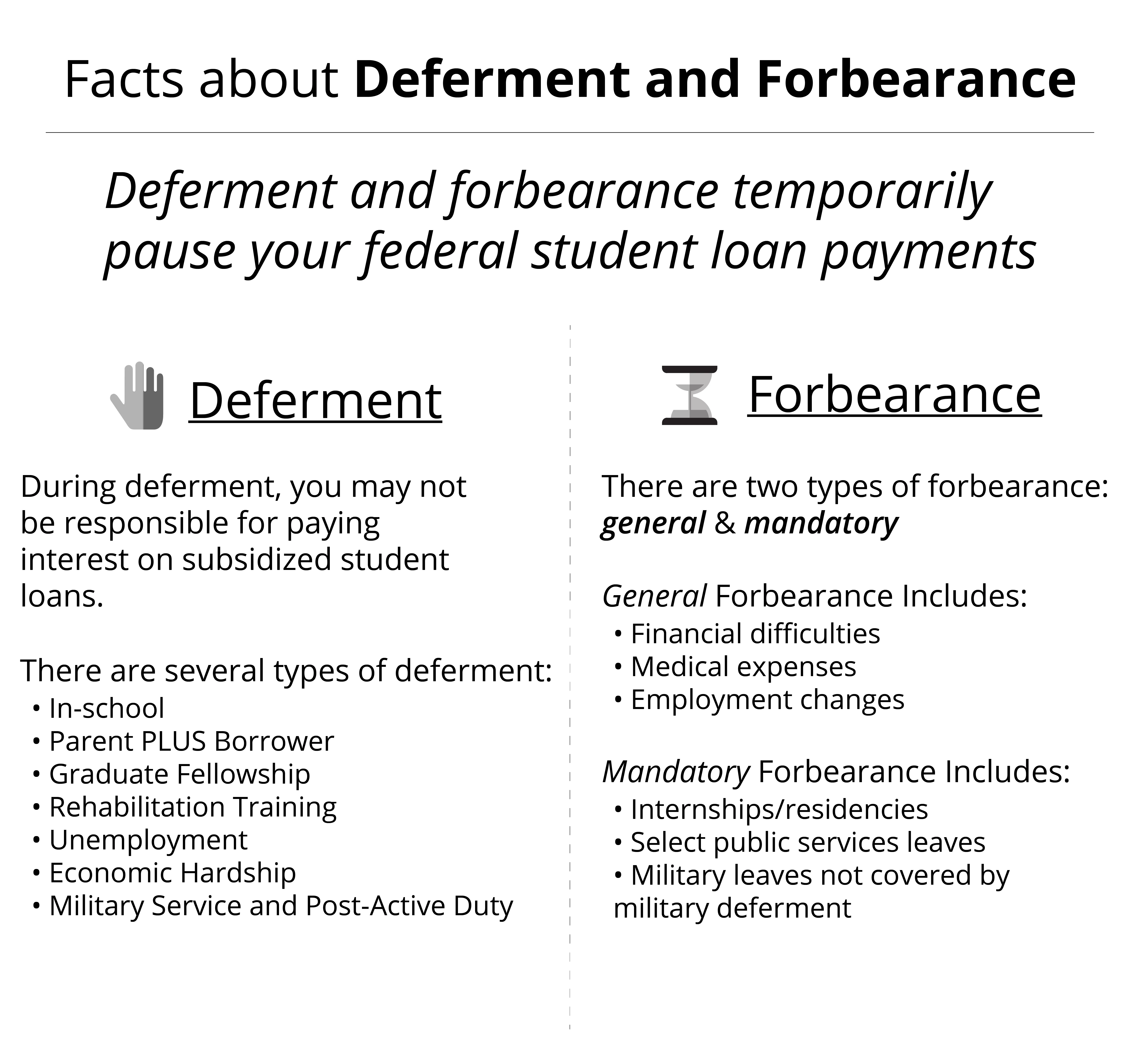

Under certain conditions, you may be able to postpone your student loan payments for up to 3 years. However, in most instances where you qualify for deferment or forbearance, you’ll receive temporary relief for up to 6 months with the option to reapply.

How to Postpone Your Student Loan Payments

If you hold federal student loans, you have a right to deferment under certain conditions or you may qualify for forbearance through the government’s Federal Student Aid program. You’ll need to work with your servicer to complete a request that best matches your situation to postpone your student loan payments. If you hold private student loans, postponement is under the discretion of your lender.

How to Know If You Should Postpone Your Student Loan Payments?

If you’re struggling to repay your student loans, you should first look for ways to lower your monthly payments. Federal borrowers have the option to enroll in income-driven repayment plans which are popular ways to lower monthly payments. In cases where you’re no longer earning an income, postponing your student loan payments is a viable option to avoid defaulting on your loans.