Blog.

5 Reasons To Offer Student Loan Benefits

As an employer, you know that benefits can be expensive, and difficult to manage. What could possibly be the advantage of adding more expenses to your budget, and why should you provide benefits that go past the standard of health insurance and paid time off?...

High Employee Turnover Rate? Ask Yourself These Questions

In order to run a profitable business, you need to be backed by a skilled set of employees. While your leadership might be the driving force behind your company’s success, without your team, you will be hard pressed to succeed. Perhaps you have no trouble finding...

The “Student Loan Effect” on Your Employees

If you have employees that are currently in the process of paying their student loans, this portion of your workforce will be facing a unique set of challenges. As an employer, understanding the role student loans play in your employees’ lives can help you to better...

Getting Employees Invested and Involved in Their Benefits

Is just offering new employee benefits enough to make your employees use it? Will your staff actually take advantage of the benefits, such as financial planning resources, that you provide? There are steps to take and other factors to consider to ensure your employees...

10 Considerations when Planning College Debt Repayment

Most high school students don’t think about student debt when they’re thinking about colleges. They likely think about what college will be like, where they want to go, what dorm they want to stay in, what they’ll go to school for, and of course, how much fun it will...

Student Debt Impacts all Income Levels & Sectors

Student debt is the literal price many of us pay to earn a college degree. Our college degrees will continue to have value as long as employers are seeking candidates with professional certification and a formal education. The cost of college can have variable impact...

5 Ways We Optimize Student Loan Repayment

Student loans are the fastest growing form of U.S. household debt. Today's generation of employees are less financially secure than previous generations, and student debt hinders millions from saving for retirement, purchasing a home, and even starting a family. ...

IonTuition Launches Default Resolution Service

IonTuition is the most comprehensive student loan benefit, covering the entire lifecycle of student loan repayment: from college planning to tracking loans while still in school, to full repayment with assistance from employer contributions. Our proactive self-service...

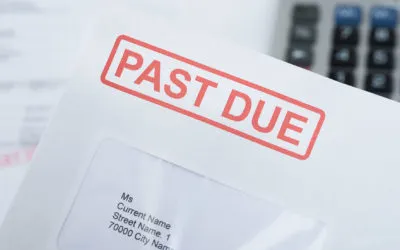

Over 1 Million Student Loan Defaults in Last 12 Months

According to the Federal Student Aid (FSA) center, 24% of all Direct Loan borrowers were delinquent or in default at the end of 2018. Since June 2018, over 1 million Direct Loan borrowers have entered default. Defaulting on a federal student loan occurs when the...

Federal Student Loan Interest Rates Dropping for 2019–2020 School Year

Interest rates for federal loans taken out on or after July 1, 2019 will have a significantly lower interest rate than last year. This is the first decrease in three years. The new fixed rates will be as follows: Loan Type2018-2019 Rate2019-2020...