Blog.

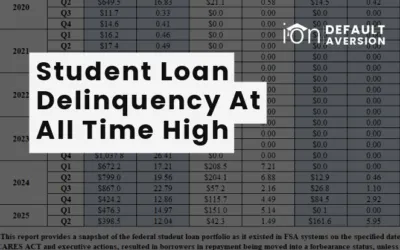

New Data: Federal Student Loan Delinquency at Record High Levels

New data released by Federal Student Aid paints a stark picture of the post-pandemic student loan repayment landscape. The numbers reveal a 6.5-fold increase in borrowers 91-180 days delinquent compared to the pre-COVID payment pause. As of FYQ2 of 2025, a staggering...

Protecting Higher Education Budgets

The growing challenges facing higher education present significant threats to college budgets. Proposed legislative changes and a looming default crisis threaten to strain institutional resources. To protect higher education budgets, colleges must prepare against...

Student Loan Defaults: What Colleges Need to Know Now

The changes within the Department of Education and Federal Student Aid raise concerns about the rising threat of student loan defaults. While the Q1 2025 data for student loan delinquency is pending, the Q4 2024 data showed delinquency rates that were three times...

IDR Applications Back Online After Court-Mandated Revision

Good news for student loan borrowers! The U.S. Department of Education’s Office of Federal Student Aid (FSA) has reopened the online income-driven repayment (IDR) plan and loan consolidation applications. This comes after a temporary pause necessitated by a recent...

What Closing the Department of Education Means for Student Loans

The White House issued an executive order to begin the shutdown of the Department of Education. While the full implications remain, colleges can prepare for changes to how federal education programs are administered. With the potential chaos on student loans after the...

Why Colleges Should Stay Optimistic

This week's leading story in higher education was about the significant reductions in the Department of Education. These cuts understandably caused concern for college leaders. Change is never easy, but colleges should focus on opportunities for growth and innovation....

College Financial Sustainability: Budget Mindfulness, Default Aversion, and Strategic Enrollment

Challenges keep coming at college financial sustainability: enrollment instability, student retention issues, growing student loan delinquency rates, and recent changing federal policies and the attempt to dismantle the Department of Education. Institutions must...

Student Loan Borrowers See Credit Scores Drop

The Wall Street Journal and other news outlets reported that student loan borrowers' credit scores are dropping. Here's a look at the current situation: Bad News: Credit scores of student loan borrowers have dropped Approximately 43% of federal student loan borrowers...

Record High Student Loan Defaults Are Coming

The warnings have been sounded. As we highlighted in previous blogs, the end of the three-year pandemic era payment pause, ongoing borrower confusion, federal servicer limitations, and economic pressures have created a perfect storm for a student loan default crisis....

How Colleges Can Thrive in a Changing Higher Education Landscape

Higher education is going through changes. Colleges and universities are grappling with complex challenges including fluctuating enrollment, rising student loan delinquency, shifting public perception, and confusing federal policy changes. These issues are not...