In a recent survey conducted by PwC, seventy-three percent of employees admitted that their finances have been a distraction at work and more than 50 percent said their productivity has been impacted by financial worries.

Without the proper knowledge of how to manage expenses – a car payment, credit cards, phone bill, a mortgage, child care, and every day expenses – your employees may find it hard to save any money. Add student loan debt to the equation, and saving becomes an even bigger challenge.

Instead of relying on employees to fend for themselves, employers can do many things – from obvious benefits like 401(k) plans to less apparent perks like gym memberships – to help reduce this financial burden.

We asked five iontuition employees what money-saving workplace perks they appreciated the most. Here’s what they said:

Top five perks that save your employees money:

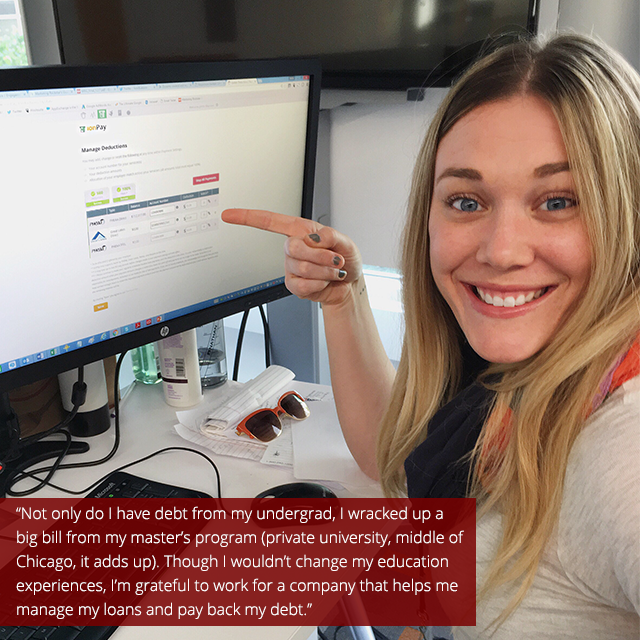

Student loan assistance program

Digital engagement manager Jamie appreciates student loan repayment assistance. This hot new workplace benefit is gaining popularity across all generations – from people who went back to school during the recession to new graduates who racked up thousands of dollars in debt.

The great essential: Coffee

If you’ve read any of Blogger Tara K’s blog posts, you know how much she likes coffee. To her, it really is an essential workplace perk. Look at it this way: There are about 260 business days in a year. If an employee spends $4 on a coffee every day, he or she would spend $1,040 in a year.

Corporate discount programs (who doesn’t love a good coupon)

Application developer Erik uses ionPerks, IonTuition’s discount program, to save money on everyday purchases. His favorite deal so far? The 30 percent discount on movie tickets!

Gym membership

Public relations strategist Trisha Jerele is a big fitness buff, so she appreciates her employee gym membership the most. Offering gym memberships could go beyond saving employees money – several studies have shown that health wellness plans can increase employee productivity.

Comped cell phone bills

Data analyst Faizan likes when a company pays for his cell phone bill, especially when he has to use it for work. Cell phones and smart phones have become a part of everyday life. If your employees work from home or are required to use a mobile device for work, consider reimbursing them.