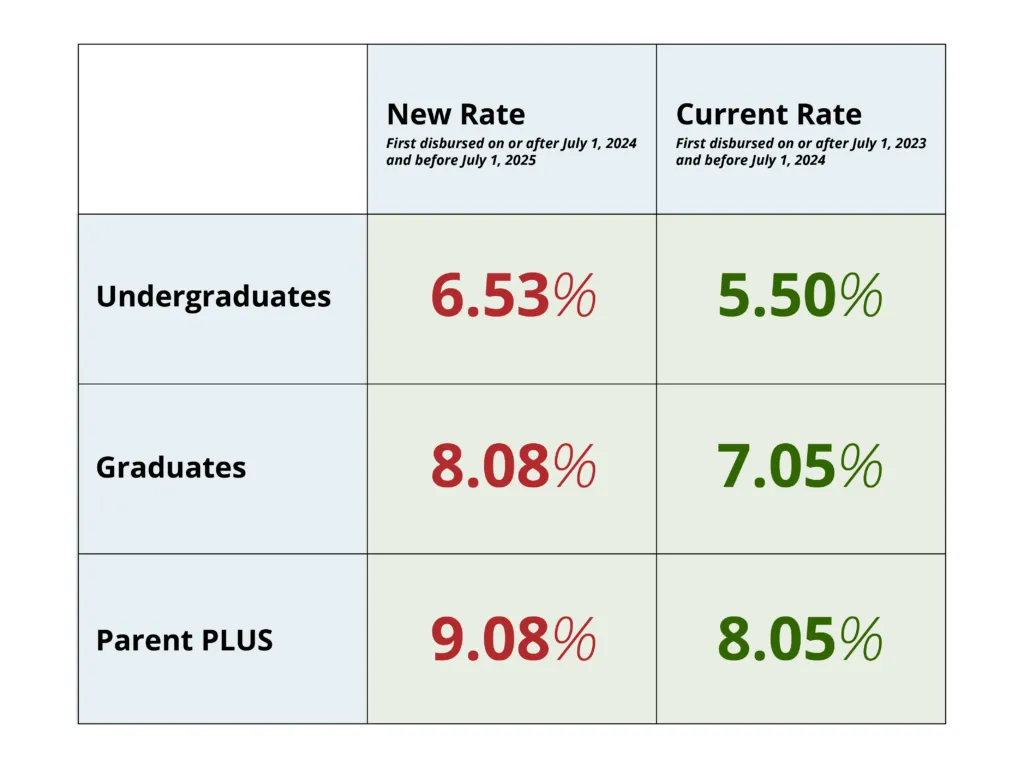

Federal Student Aid announced that Direct Loan Interest Rates for student loans disbursed for the 2024-2025 school year will increase from last year.

Interest rates are determined annually and set for a 12-month period. Rates are determined by a formula tied to yields on 10-year Treasury notes, which were recently auctioned. There has been a rise in interest rates across the Federal Reserve as they continue to battle inflation.

While the increase may seem small, this can add up over the life of the loan. The rise in fixed interest rates will cost borrowers approximately $5 extra in monthly payments on a $10,000 ten-year loan. This can accumulate to over $600 over the life of the loan.

Federal Student Loan Interest Rates Can Push More Borrowers to Income-Driven Plans

Historically, student loan interest rates have risen as high as 14 percent, as they did in the early 1980s. In the 2020-2021 academic year, interest rates for undergraduate loans were 2.75 percent.

However, borrowers are more likely to qualify for an income-driven repayment plan with higher monthly payments. The new SAVE income-driven repayment plan has more favorable terms for borrowers struggling with their loan payments. SAVE also includes forgiveness in as few as 10 years.

Student Loan Repayment Management

IonTuition specializes in helping student loan borrowers manage their federal repayment plans. Our default aversion plan includes online applications for income-driven repayment plans, outreach to borrowers throughout the repayment cycle, and access to live repayment specialists to help borrowers find sustainable repayment plans.