Student Loan Default Management

Loan repayment has started. Mitigate your risk.

The most reliable student loan servicing and default aversion platform for colleges & universities to lower Cohort Default Rates and help borrowers find sustainable repayment plans.

Student Loan Default Management

Loan repayment has started. Mitigate your risk.The most reliable student loan servicing and default aversion

platform for colleges & universities to lower Cohort Default Rates

and help borrowers find sustainable repayment plans.

We’re there from enrollment to beyond graduation

In School

Your borrowers receive early communication to prepare for loan repayment.

Grace

Your students prepare by exploring their repayment options.

Repayment

Your borrowers are guided to sustainable repayment options.

Default

Borrowers are guided out of default and back into good standing.

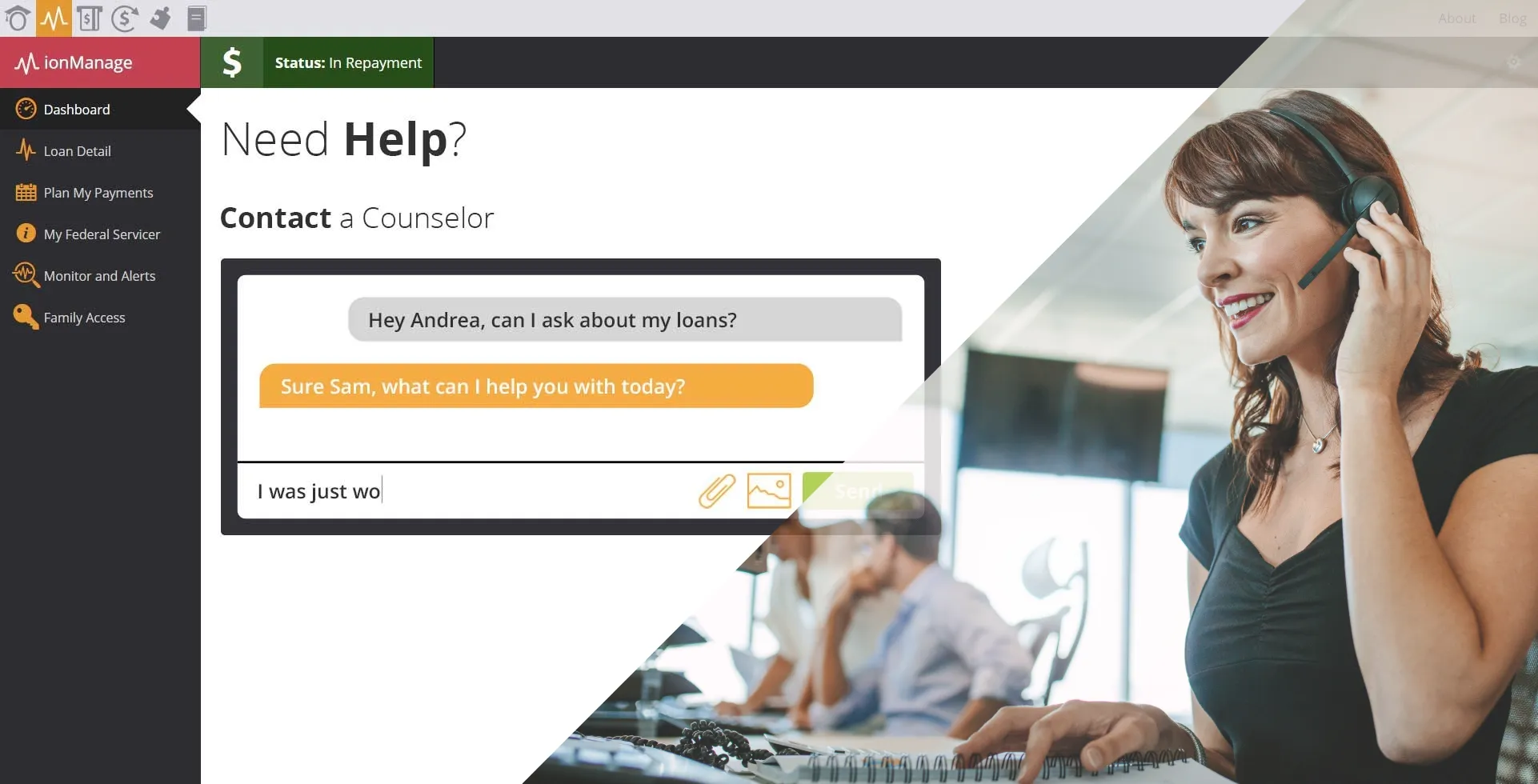

Live Omni-Channel Support: online, phone, chat, email, text

Student Loan Management: Online portal with aggregated information across all federal loans

Repayment Planning: Help borrowers understand their repayment obligations and find sustainable options.

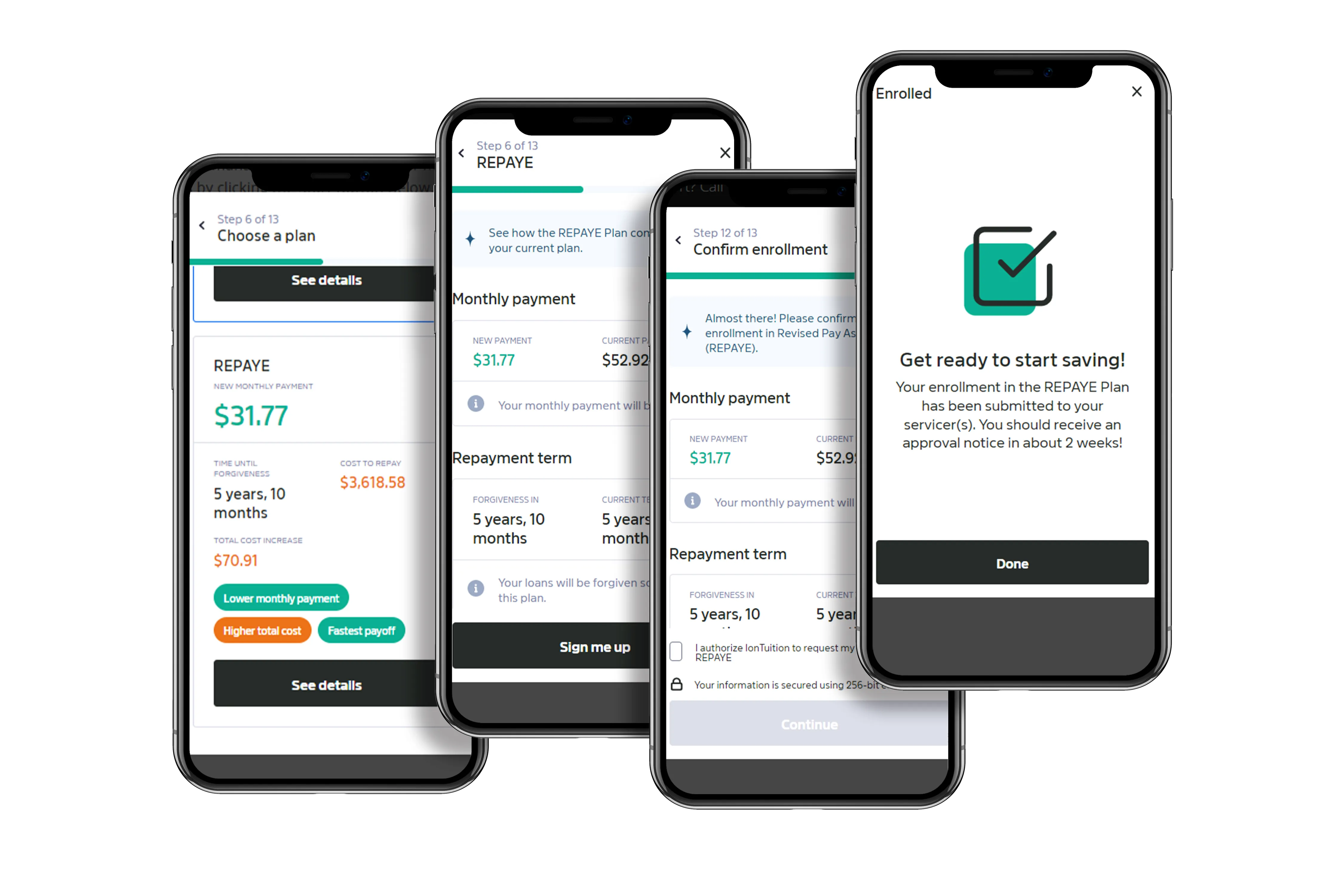

Built-In Repayment Plan Applications

Your borrowers avoid long wait times with servicers by applying for plans such as income-driven repayment directly on the ION portal.

Custom Reports: Delinquency, Default Rate Forecasting, and Performance

Real-time data is valuable. We provide operational reporting to track our performance as well as insights into student repayment status.

Give Your Students the Tools to Succeed

- Deliver online entrance and exit counseling to all students using Title IV aid

- Remain compliant with the U.S. Department of Education requirements

- Access to IonTuition’s loan repayment management platform

- Monitor student progress and obtain electronic confirmation/reports of counseling completion

How high will your institution’s CDR be?

Federal Student Aid projects 10 million borrowers will default on their student loans, but you’ll be on the hook for high CDRs.

Schedule a meeting today to receive a review of your student borrower data and your risk for a high CDR: