There are many ways colleges and universities are recognized as top performers. Some schools count the number of Nobel Laureates they’ve earned while others pride themselves in having the most football championships. At iontuition™, we recognize top-performing schools by the quality of their financial literacy program. Our 2016 Financial Literacy Trends on Campus Report discusses the traits that allow top-performing schools to get superior results from their financial literacy programs.

Here are the five things top-performing financial literacy programs have in common:

They make financial literacy a priority

Our report indicated that top performing schools place more of a priority on financial literacy than average performers. More than 75 percent of top performers say they place a high priority on financial literacy compared to just 33 percent of average performers.

They dedicate budget dollars to financial literacy

Top-performing schools include financial literacy in their budget, whether it’s in the form of actual money or human capital. Almost 60 percent of top performers include financial literacy as a part of their annual budget and more than 85 percent have a person or team dedicated to overseeing their financial literacy program.

They take advantage of technology

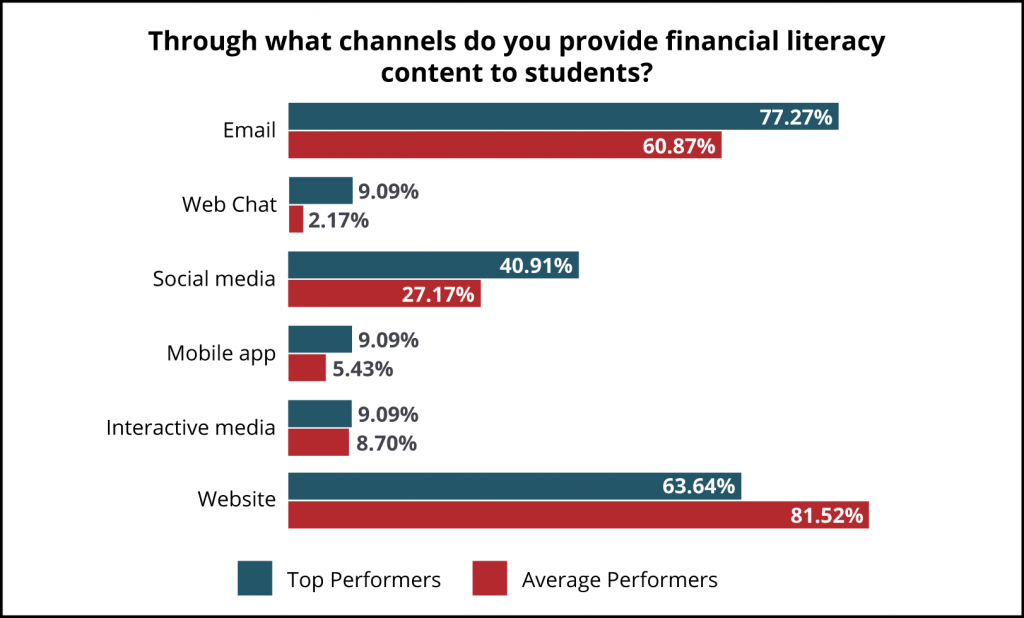

According to our report, top performers are more likely to use new technology to reach students than average performers are. High performing schools are three times more likely to use web chat and almost twice as likely to use mobile applications. More than 40 percent use social media. They use these methods along more traditional methods such as phone calls, classroom education, workshops, and one-on-one counseling.

They focus on continued engagement

More than 80 percent of top performers rated their school’s communication with student loan borrowers post-graduation as highly effective or effective, compared to just 58 percent of average performers. Reaching out to students during the grace period helps reinforce what students learned during their college years, and keeps them focused on successful student loan repayment.

They provide students innovative tools

Equipping students with the right tools — like iontuition’s student loan management dashboard — make a difference. iontuition makes it easy for student borrowers to get an accurate and comprehensive look at their loans while they are in school. It allows them to see how much their loan payment will be after graduation so they do not over borrow. After students leave school, they have access to on-demand student loan counselors who can help them choose a best-fit repayment plan.

Learn more about iontuition’s solutions.

Definition of a top-performing school

The definition of a top-performing school is based on data from the 2016 Financial Literacy Trends on Campus Report. About 20 percent of respondents were considered “Top Performers,” or those respondents who self-reported their school has a strong financial literacy program. All other respondents were grouped into the average performer bucket.