It’s easy to mistake the terms “consolidation” and “refinancing.” It’s understandable to believe that the only way to consolidate student loans is through refinancing. While refinancing does consolidate student loans, that doesn’t mean that’s the only method.

What is student loan consolidation?

The definition of “consolidation” is combining many things into a single more effective whole. In the world of student loan repayment, this means combining multiple student loan payments into one monthly payment. Most student loan borrowers have multiple federal loans. Since loans are disbursed each semester at college, and it takes many semesters to graduate, borrowers often have upwards of 8 or more student loans to repay, all with potentially different repayment terms.

A Federal Direct Consolidation Loan combines all of those student loans into one payment with one interest rate and repayment date. From a certain point of view, a person might consider this to also be refinancing student loans, but the term refinancing is reserved for private lenders.

Watch out for student loan consolidation scams!

Consolidating your federal student loans is free. Do not accept offers from private companies that offer to consolidate your student loans for free.

Should I consolidate my federal loans?

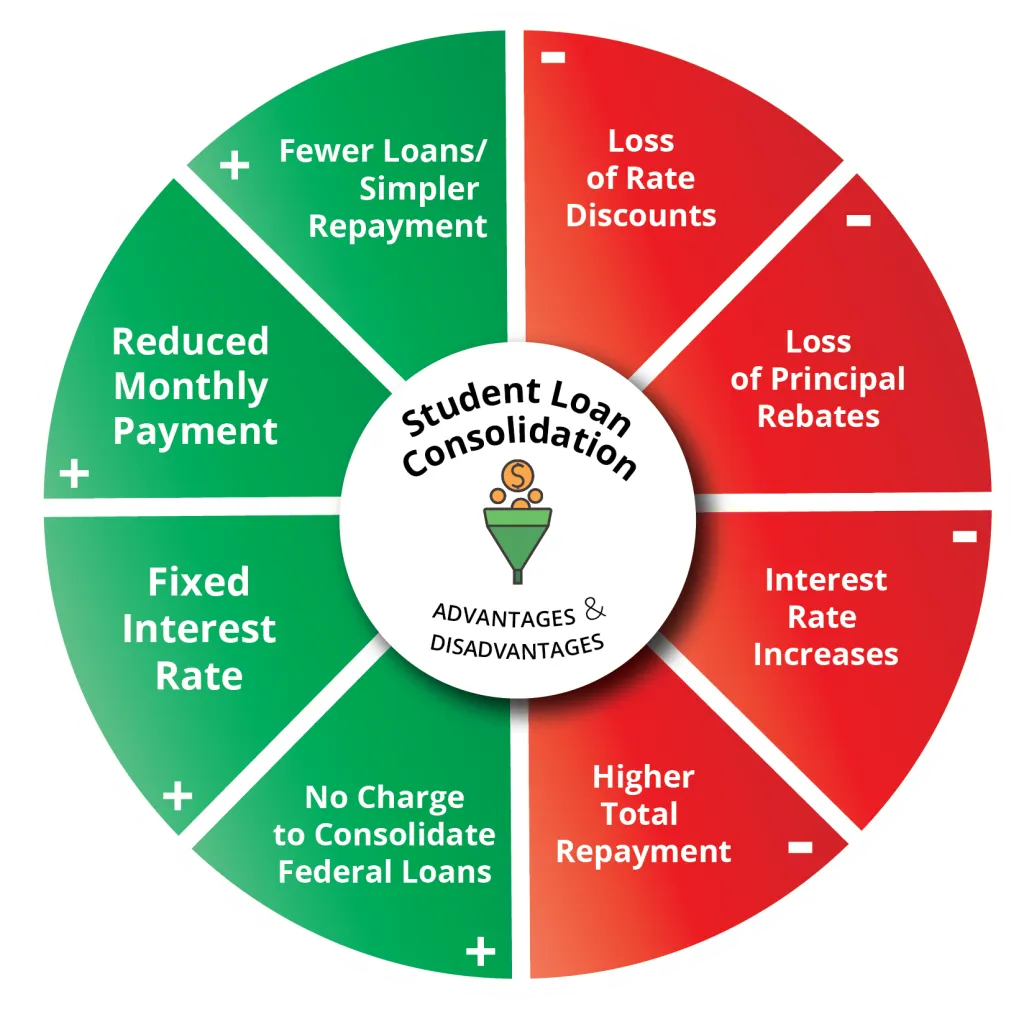

That depends on how well you’re handling your repayment. By consolidating your federal loans, you’ll likely increase the length of your repayment. If this is necessary because you’re having trouble making your payments, consider an income-driven repayment plan first.

There is no federal refinancing option

If you’re interested in refinancing, you’re probably looking for a better interest rate. Federal consolidation doesn’t necessarily result in better interest terms. There is no federal program for student loan refinancing. If you would like to refinance your student loans, you’ll have to apply through a private lender. In this instance, the private lender will pay off your existing student loans and issue you a new student loan. In a way, this does consolidate multiple loans into one monthly payment, but the correct term is still refinancing.

Choose Refinancing Wisely

With so much student loan debt to go around, financial lenders are eager to refinance student loans. Make sure you use a reliable partner to find the best refinancing lender.

If you’re having difficulty with your student debt, consolidation and refinancing are options to simplify your student loan repayment. IonTuition not only offers student loan counseling to help borrowers understand their repayment options, but we also offer a multi-lender refinancing marketplace so borrowers can compare offers and find the best possible plan.