Parents of a newborn who are curious about saving for your child’s college education should consider the following:

- let’s say the annual current cost of college is $25,000,

- college costs have an inflation rate of 4%,

- a college investment account returns 6%, and

- your child will attend college right after high school

– in this case, it would cost you nearly

$200,000 more to borrow for your child’s college education than to

save from birth.

Saving for your children’s college can be stressful, so it’s good that you’re thinking about your child’s college early.

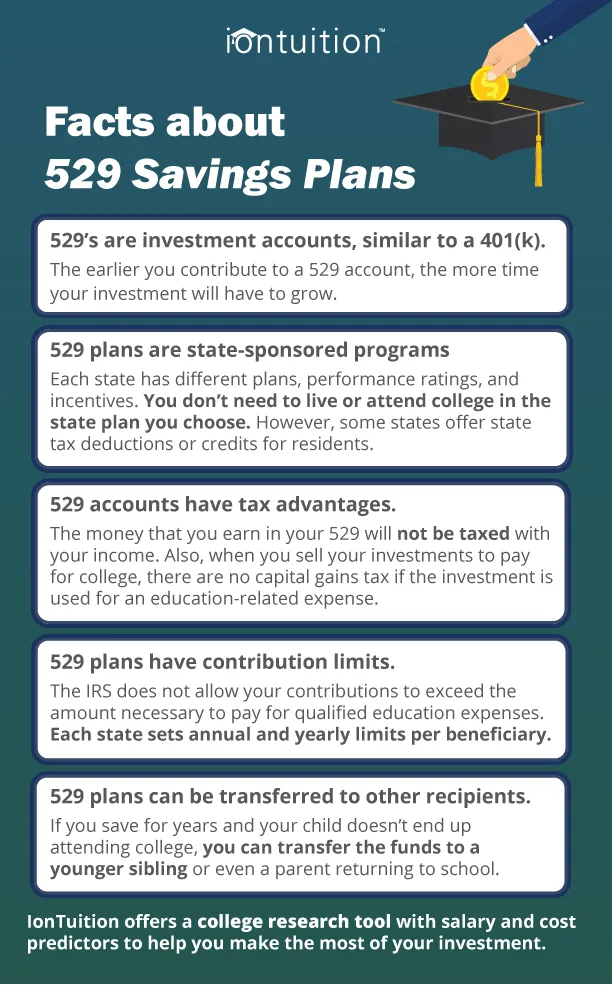

529 Plans are a Tax-Advantaged Way to Save for College

It’s difficult to predict the cost of college in the next decade or two, let alone which college (if any) your child will attend. It’s also difficult to put money away for college if you’re struggling to pay off debt and contribute to your retirement.

A 529 plan is a college savings program sponsored by a state agency. Similar to other investment products, you can allocate your money to index or mutual funds to receive a return on your investment.

529 Plans Are Relatively New

The 529 plan was instituted in 1996, but it took several years for it to develop and catch on. This means that few parents have had the opportunity to use the plan since their children’s birth. Only

13 percent of families reported using 529 plans to pay for college this year. Families that did use 529 plans contributed an average of $10,000.

Like many investment products, compound interest and time is your friend. The longer you invest, the more money you’ll accumulate. It’s never too late to start. The difference between saving when your child is 10-years old instead of 14-years old could potentially earn you thousands of dollars.

529 Plans Don’t Need to Cover the Full Cost of College

Currently, the average cost for a four-year, in-state college education is approximately

$38,400. The maximum aggregate federal loan limit is

$31,000. This means you can expect federal loans to cover about

80 percent of college costs. Keep in mind that about 5 cents of every dollar in your 529 goes against your child’s financial aid package through FAFSA. That means families should plan on covering about

20 percent of their child’s college.

If trends continue, college will easily cost

over $100,000 in the 2030’s, meaning families should set their conservative college savings goal at

$40,000. Under a 529 plan, families that save

$120 per month for 18 years while earning average returns can accumulate over $40,000.

529 Plans are Only One Method to Save for College

There are several options to save for college including prepaid tuition, Coverdell accounts, bonds, and even some Roth IRAs can be exempt from withdrawal penalties if the funds are used for education.

However, many students attend college with

little or no savings at all. Student loans are the most common method of paying for college.

IonTuition is dedicated to helping families make the most of their higher education investment. We’re here to help our users with

college savings and student loan repayment.