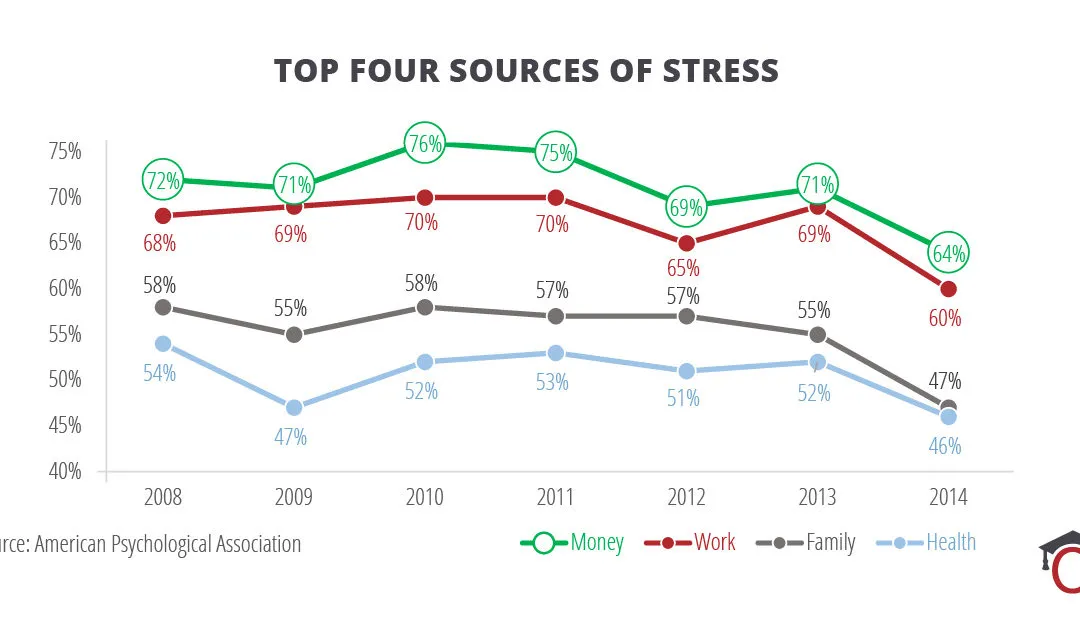

Stress is a factor in everyone’s life. The main source of stress is financial concerns, according to the American Psychological Association. Almost three-quarters of adults report they’re stressed about money at least part of the time and 64% cite money as their top source of stress. The impact of that stress often follows people to work, having a negative impact on employers.

According to the Society for Human Resource Management, more than 60% of human resources professionals say the financial health of their employees is no better than “fair.” Stress caused by concern over financial health can affect employees’ physical health, lead to absences and decrease productivity. In fact, 37% of HR professionals said employees have missed work because of financial emergencies in the past year.

Employees of all ages experience financial stress; from Millennials struggling with student loans to GenXers paying for their children’s college education to Baby Boomers facing retirement. One reason financial stress is so common in the workplace is because many employees do not have the knowledge to deal with their finances appropriately. HR managers report only 13% of employees are “very financially literate.” The majority, 70%, say employees are only “somewhat financially literate.”

This issue will not go away, especially because the next generation of workers is the most debt-burdened generation to ever enter the workforce. The average college-educated employee enters the workforce with an average of $35,000 in student loan debt, yet many do not have the knowledge needed to effectively deal with their student loan debt. Because of this, an increasing number of companies are starting to introduce benefits that help employees learn about and manage that debt. Student loan management tools such as iontuition allow employees to get a comprehensive picture of their loans, set up a payment plan that works within their budget and talk to student loan counselors if they need help.

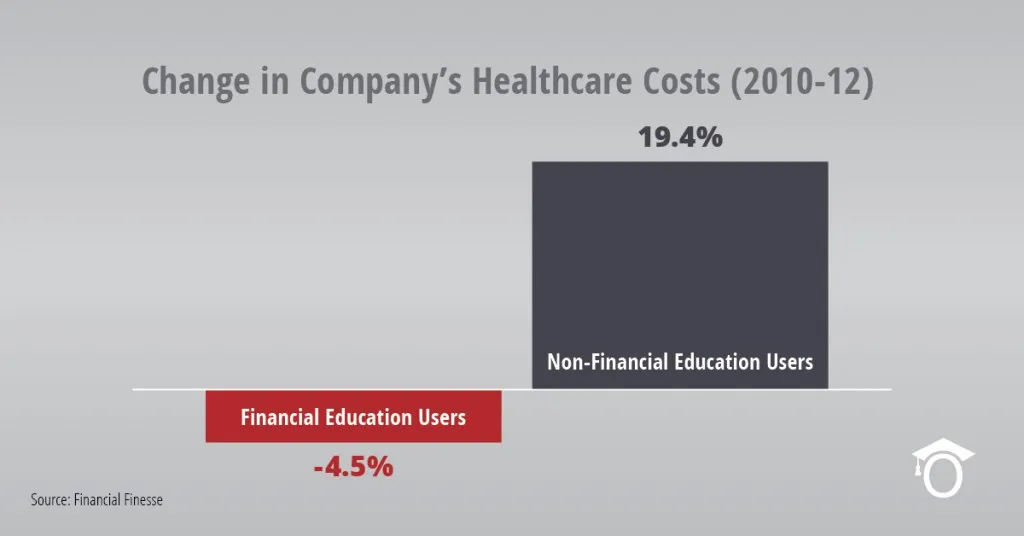

Focusing on financial wellness in the workplace will generate savings in surprising areas. With finances secure, employees are less likely be distracted or need to take time off to deal with financial issues, improving productivity. Even healthcare costs can go down. Financial Finesse found that people who took advantage of financial education benefits had a 4.5% decline in health costs, compared to a 19.4% rise among people who didn’t get financial education. People with the financial wellness benefit were also more likely to participate in Flexible Spending Accounts and 401(k) plans.

Helping employees better manage their finances can decrease workplace stress, improve productivity and provide organizational cost savings. As a new, debt-burdened generation of employees enter the workforce, innovative benefits like student loan management and financial literacy tools will be common-sense ways to help employees deal with their finances and show you are committed to their long-term financial success.