Earlier this week, President-Elect Trump announced on social media that he intends to close the Department of Education (ED) early in his administration and transfer responsibilities of educating our children to the states.

Closing ED would require Congressional approval. In 2018, President Trump proposed moving ED under the Department of Labor, but Congress rejected that idea in 2018. Many GOP conservatives have long believed that ED is inefficient and that state-run education departments could better support low-income families and address the needs of children with disabilities.

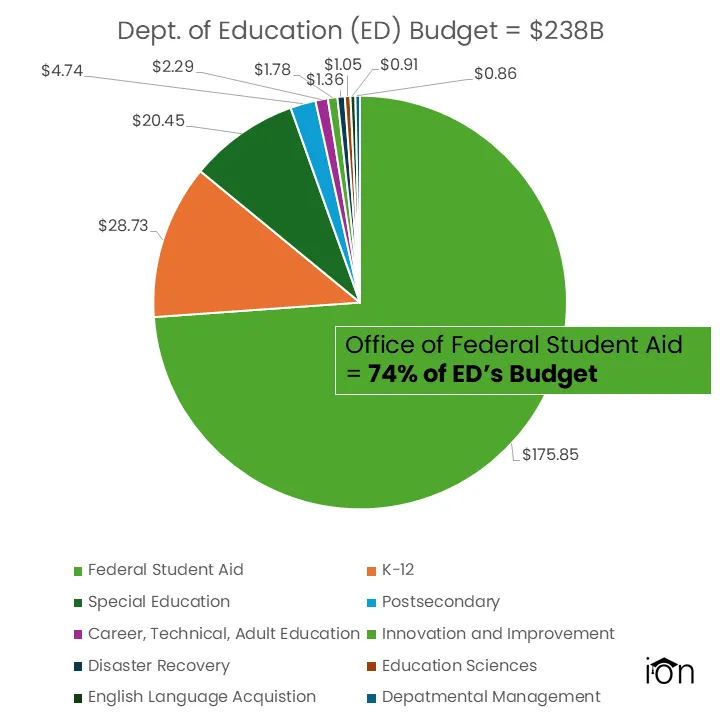

What remains unclear is the future of the Office of Federal Student Aid, which makes up 74% of the Department of Education’s annual budget.

What is the Role of the Department of Education?

ED’s mission is to “promote student achievement and preparation for global competitiveness by fostering educational excellence and ensuring equal access for students of all ages.”

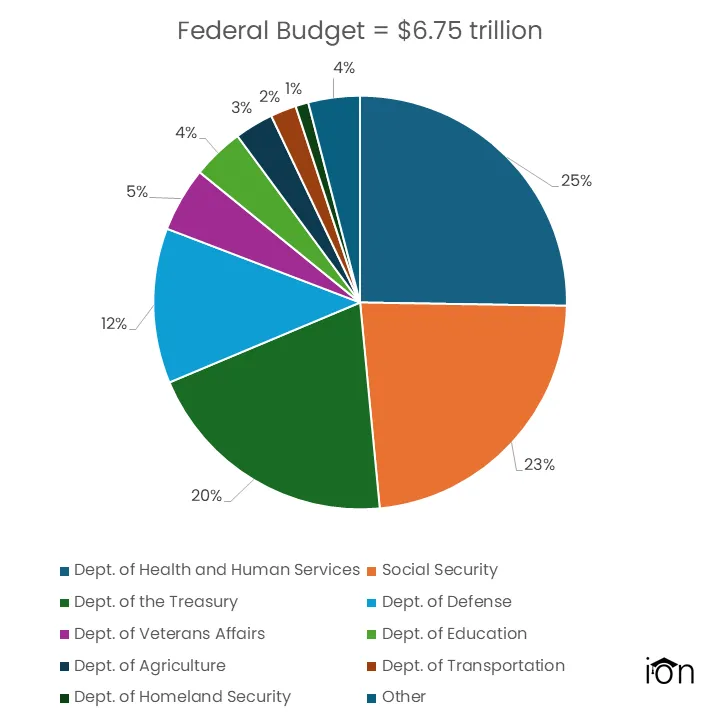

Despite this vital role, ED represents only a fraction – between 2% and 4% – of the overall Federal budget:

The Department of Education is a minor cost compared to Social Security, national defense, and healthcare. Federal grants have long been used to support low-income families through Title I, while children with disabilities receive assistance through the Individuals with Disabilities Education Act (IDEA).

The Role of Federal Student Aid

Title I and IDEA funding combined do not come close to the cost of federal student loans. More than $175 billion goes toward operating the Office of Federal Student Aid, with the majority allocated to the Direct Federal Student Loan Program.

If the Department of Education were to close, the Office of Federal Student Aid, its 1,500 employees, and the $1.7 trillion student loan portfolio, could be transferred to the Treasury Department. Project 2025 suggests that the Treasury Department “would manage collections and defaults” and FSA and its obligations would be spun off into a new government corporation.

Potential Impacts on Student Loan Borrowers

Student loan borrowers face multiple changes, including the suspension of several student loan initiatives proposed by the Biden administration, such as the SAVE income-driven repayment plan and new forgiveness proposals.

If ED closes, further confusion is likely as policies and responsibilities evolve under the new administration. This year has already seen delays in FAFSA processing and court injunctions against the SAVE plan.

Having a default aversion plan in place through IonTuition can help borrowers navigate these changes, stay ahead of potential confusion, and find successful repayment options in the years ahead.