Court Temporarily Blocks Biden Administration’s Latest Debt Relief Plan

This week, a federal judge granted a temporary restraining order against the Biden administration’s student debt relief plan, which may lead to record-high student loan defaults.

The Department of Education is forbidden from any mass cancelation of student loan debt until the legal challenges can play out in court.

This was the student debt relief plan released by the Biden-Harris administration last April which promised automatic forgiveness of up to $20,000 for borrowers whose loan balances exceed what they owed upon starting repayment.

The plan would also eliminate debt for borrowers who have been in repayment for over 20 years.

The relief was scheduled to go into effect this fall.

The lawsuits filed by GOP-led states argued that the Education Department lacks the authority to grant this sweeping forgiveness.

This puts student loan borrowers in a state of limbo, because if you’re a student loan borrower who qualifies for forgiveness, why would you continue to make payments?

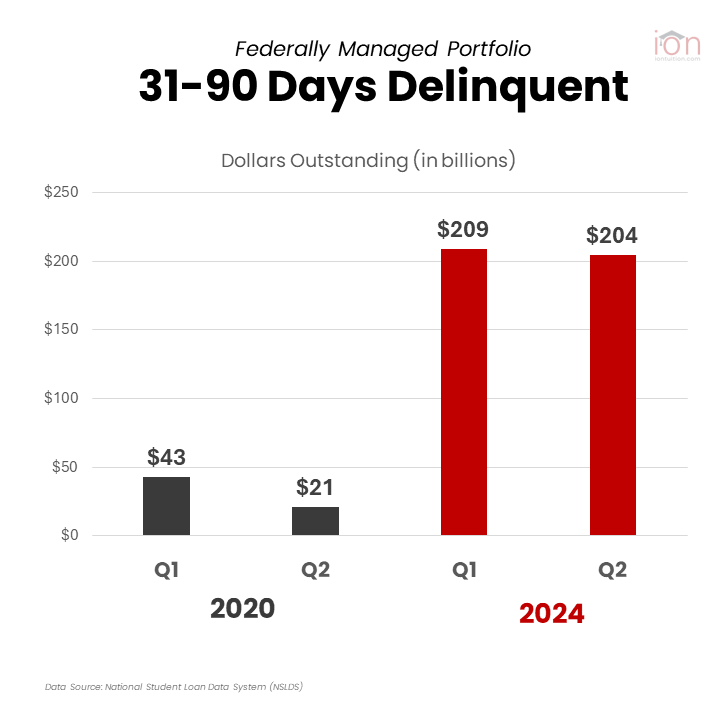

Delinquency Rates are at Record Highs

This is evident by the delinquency rates for the first two quarters of this year.

Remember, repayment resumed last fall with a one-year on-ramp period. The on-ramp allows borrowers to miss payments without delinquencies being reported to credit agencies.

What federal servicers have done during the on-ramp is place borrowers into forbearance after three missed payments. As such, during the on-ramp period, borrowers will appear in the 91-180 days delinquent bucket only temporarily until their loans can be reset, and no loans will show as more than 180 days delinquent until after the on-ramp period ends.

So, if you look at the 31 – 90 day delinquency bucket for federally-held loans, about 7 million borrowers are showing as delinquent for the first two quarters of 2024.

If you compare that to the first two quarters of 2020, before the three-year COVID payment pause, there were only 1.3 million borrowers delinquent, and even if you add up ALL of the other delinquency buckets up to 360 days, it’s still only half of the number of delinquent borrowers today.

Delinquencies Turn into Student Loan Defaults

If borrowers continue to skip their payments hoping for forgiveness, they will eventually default.

So, if you’re a school you should start thinking about Default Rates for the 2024 Cohort, which begin counting when repayment resumed on October 1, 2023. That three-year CDR will be here before you know it, and you can expect it to be double or triple your pre-covid student loan defaults.

Unless you put a default aversion plan together now.