12-Month On-Ramp for Federal Student Loans to Expire Soon

The Department of Education’s 12-month on-ramp for federal student loans expires September 30th.

The on-ramp prevents the worst consequences of missed, late, or partial payments, including negative credit reporting for delinquent payments. During this period, borrowers’ loans are automatically put into forbearance after missing three payments.

Impact of the On-Ramp on Delinquency

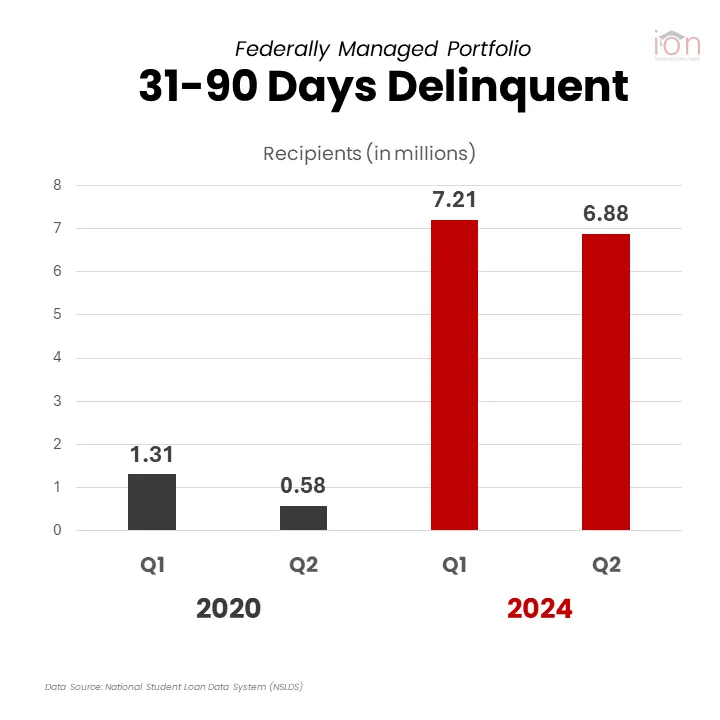

Because of the on-ramp, no borrowers are showing as more than 180 days delinquent, but it’s clear that many are not making payments. Over 7 million borrowers are currently in the 31-90 days delinquent bucket, which is five times higher than before the COVID payment pause.

Default Risk After On-Ramp Expires

Many of these borrowers would likely be in default if not for the on-ramp. A study by Qualtrics on behalf of Intuit Credit Karma reveals that one in five (20%) student loan borrowers have made zero payments toward their loans during the on-ramp period. Moreover, 63% of borrowers have not been making consistent on-time payments.

Higher Delinquency Among Lower-Income Borrowers

This figure climbs to 27% among borrowers with household incomes below $50,000. Nearly half of all borrowers feel financially unstable, and more than half say they are unable to afford their student loan payments.

Higher-income Borrowers Don’t Qualify for the SAVE Plan

But what about income-driven repayment (IDR) options like the SAVE plan? 40% of borrowers report that they make too much to qualify for an IDR plan but still can’t afford payments. Additionally, only 48% of borrowers were aware of the SAVE plan option.

Confusion over Student Loan Debt Relief

Another reason borrowers are not making payments is confusion over student loan debt relief. Last year, the Biden administration promised a one-time student loan forgiveness of up to $20,000, which was later blocked by the Supreme Court. The administration has since promised a Plan B for more relief, including the SAVE plan, but most efforts have been held up in court.

As a result, 36% of student loan borrowers say they are not making payments toward their loans in hopes that their debt will be forgiven.

Legal Delays for the SAVE Plan

Currently, the SAVE plan is still on hold. The appellate court will not rule on it until at least last October. After that ruling, it’s likely the case will escalate back to the Supreme Court, meaning a final decision may not come until early or mid-next year.

Consequences for Colleges

In the meantime, colleges will need to implement strong default aversion plans to prevent those 7 million delinquent borrowers from ending up in default.