Congratulations on getting into your top three schools! It may seem like the hard part is over, but the hardest part of all – committing to a school – has just begun. The college admission process is filled with daunting deadlines, and a very important one is approaching: College Decision Day. Time may not be on your side, but don’t worry. Sit back, take a deep breath, and continue reading. You’re only a few steps away from making a decision.

Step one: Self-reflect

Selecting the right college is probably one of the biggest decisions you’ve had to make. Before any big decision, it is important to self-reflect. Make decisions based on your own wants, needs, and goals. Ask yourself these questions:

• What would my ideal profession be?

• What program would I need to be in to work towards that profession?

• Do I need a bachelor’s or master’s degree?

• Where do I see myself in 10 years?

Step two: Calculate your return on investment

For most people, a college degree is the second biggest investment they will make after a mortgage. Unfortunately, the college selection process is dominated by lifestyle considerations, and very few people think about college as a financial investment. Don’t let that be you.

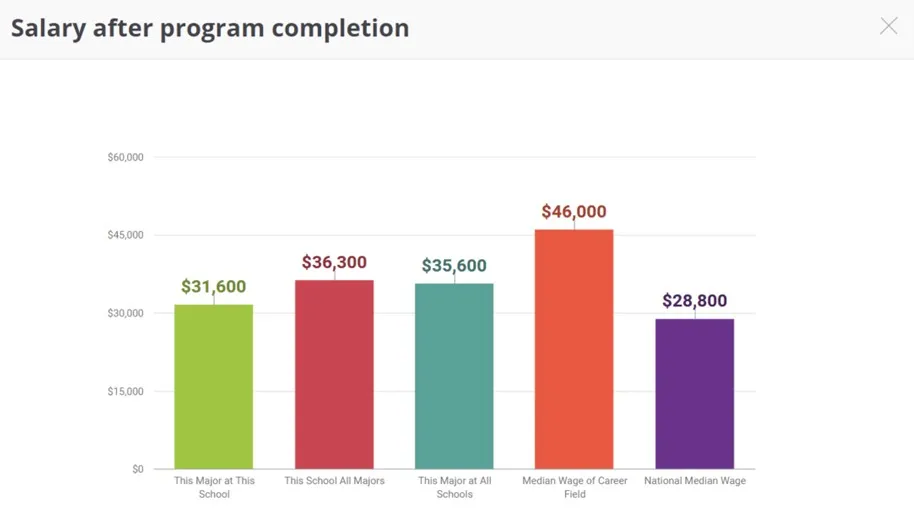

To calculate a simple return on college investment, divide your expected salary (return) by total college cost (investment). When calculating your investment, remember to factor in costs for room and board, tuition, textbooks, entertainment, school supplies, and more. Think of the total amount of money it will take you to earn that degree. When calculating your expected salary, make sure to compare it by school and by program. If you get a degree in marketing from School A, will your expected salary be more or less if you get a degree in marketing from school B? How does that compare to the median salary for marketing?

Here’s a snapshot of some of the salary comparison data in our ionMatch tool:

Remember that your salary (return) will likely increase every year, for many years. That makes a college degree a wise investment in almost every scenario. Some degrees and schools will provide more of a return than others.

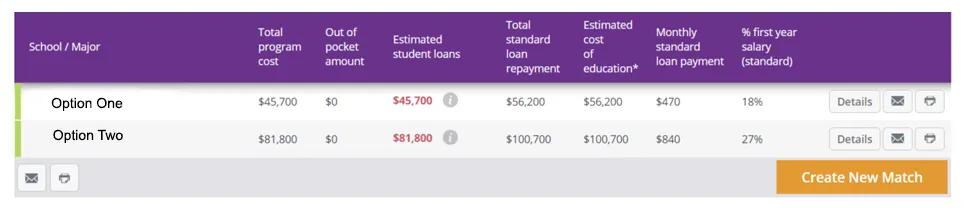

Don’t forget, if you rely on student loans to pay for your degree, you’ll have to pay interest on them. The more student loans you take out, the more of an investment you’ll have to make over time due to interest.

Here’s how we break down the college investment for students in our ionMatch tool:

Step three: Consider your ideal college experience

If you’ve narrowed down your list to a couple of schools you can afford, make sure to think about the type of college experience you want to have.

Some lifestyle considerations include in your college decision:

• Location: Will you have to move? Is it in a location you could live for four years?

• Student population: Do you want to go to a big school or small school?

• Student to faculty ratio: How many students are there per faculty member?

• Type of school: Do you want to attend a traditional university or an online school?

• Academic calendar: How is the calendar structured? Semesters? Quarters?

• Graduation rate: How many students graduate?

• Extracurricular programs: Do you want to participate in them?

Did that help?

We hope so! Tweet at us and let us know what school you decided on!